Why Company Share Option Plans Are Worth A Fresh Look

Wednesday, 21 June 2023By David Pett & Suzannah Crookes

Background

Introduced by Mrs Thatcher’s government in 1984, this legislation (in what is now sections 521 to 526, and Schedule 4, of the Income Tax (Pensions & Earnings) Act 2003), affords relief from income tax and national insurance contributions (NICs) on gains realised in an employment-related share option.

Originally known as 'discretionary share option schemes', changes made in 1996 meant that to qualify for relief, options must be granted in accordance with, a Company Share Option Plan which had been approved by HMRC before 2014, or which is registered with HMRC and self-certified as compliant by the company. Such share options are referred to as “CSOP options”.

Provided the individual meets the eligibility requirements, the grantor may pick and choose those qualifying individuals to whom CSOP options are granted.

The price at which the shares may be acquired through a CSOP option must be not less than the unrestricted market value at the time of grant (or at such earlier time as is provided for in HMRC guidance), and there is a limit on the aggregate unrestricted market value of the shares (as at grant) over which one or more CSOP options may be held by an individual. This was originally set at the greater of £100,000 or 4 x salary, but was, from 1996, fixed at £30,000.

If the option is exercised within 3 and 10 years from the date of grant (or, if the option holder dies, within 12 months of the death), the gain on exercise is relieved from income tax and NICs. Instead, the optionholder is charged to capital gains tax when the option shares are disposed of, on the gain over the price paid for the option shares. Exemption from income tax and NICs is also given if the option is exercised within 3 years of grant:

- Within 6 months after the optionholder ceases to be in qualifying employment by reason of injury, disability, redundancy, retirement, TUPE transfer or because a participating subsidiary leaves the group (assuming that the CSOP so provides);

- If the CSOP option is exercised within 6 months after the company is subject of a change of control and as a result the optionholder receives only cash in exchange for the shares acquired on exercise of the CSOP.

Until now, a majority of the class of the shares which may be put under a CSOP option must have been either 'open-market shares' (not employment-related shares) or 'employee-control shares' (i.e. shares held by employees or directors which afford them control of the company). In effect, this has meant that the option shares, must have been of the senior class in issue (or another class held by third party investors/shareholders) or of the class by virtue of which employee and director shareholders have control of the company and not – as is permitted in the case of Enterprise Management Incentives – a special class of “employees’ shares”. This was known as 'the para 20 requirement'.

Following the receipt of responses to a 'Call for Evidence' by the government in 2021 in relation to the use of EMI share options1, the government, in 2022, broadened the scope of their review to include CSOP options. The result is that the Finance Bill 2023 now provides, in clause 16, that:

- The limit of £30,000, on the unrestricted market value of shares over which unexercised CSOP options may be held by an individual is, from 6th April 2023, doubled to £60,000; and

- The para 20 requirement is removed. It follows that CSOP options may now be granted over a specially-created class of “employees’ shares” which have rights and restrictions which do not apply to other classes of shares in issue. This applies to options granted on or after 6 April 2023 and to shares acquired on or after that date regardless of when the option was granted.

A CSOP registered with HMRC before 6 April 2023 has effect with any modifications needed to reflect these changes2.

How Have CSOPs Been Used Until Now?

According to the latest available government statistics, the value of shares put under CSOP options is substantially less than the value of shares put under other tax-favoured share options (such as being SAYE and EMI share options) or share awards made under a Share Incentive Plan. In terms of the value of relief afforded upon the exercise of CSOPs, it is one-tenth of the cost to HM Treasury of EMI share option reliefs. The number of companies which have established CSOPs has remained broadly level over the five years to 2021 at c 1,300, a figure which exceeds the numbers of companies which have established SAYE share option schemes and SIPs but is far below the number of companies with EMI plans which grew by around 50% to some 14,000 over that period. This does not reflect the number of companies actually granting CSOP options each year which remained constant over that period and far below the number of companies granting EMI options. In 2021 the total value of shares over which CSOP options were granted was roughly one-third of that of the shares over which EMI options were granted. The average gain of an individual relieved from tax upon exercise of CSOP options in 2021 was £11,800, compared with £77,800 for EMI share options.

Capital Gains Tax Consequences

The amount of the average gain realised upon exercise of a CSOP option suggests that many participants in a CSOP will not previously have been troubled with a liability to capital gains tax as that amount has, until now, been less than the level of annual personal exempt amount (£12,300 for 2022-23). The dramatic reduction in the CGT annual exempt amount (£6,000 for 2023-24, and £3,000 for 2024-25) will not only bring large numbers of those exercising CSOP options into the capital gains tax net, but will also mean that those individuals not otherwise required to submit a self-assessment return would, if their total chargeable gains are above the annual exempt amount, become obliged to complete such a return or to report via the ‘real time’ capital gains tax service. Failure to do so within the statutory time limits will attract an automatic penalty. It is far from clear that CSOP optionholders and their employers have yet woken up to these very real consequences of the reductions in the annual exempt amount.

What Changes Could Usefully Have Been Made?

Rather than specific changes to the CSOP regime, a better approach may have been to roll the CSOP regime into the EMI share option regime (which would have allowed greater commercial flexibility in the terms for which options may be exercised in circumstances qualifying for tax relief), but applying different individual limits to the grant of qualifying options to employees of larger companies not qualifying to grant options under the existing EMI regime. This would have greatly simplified the rules, and in doing so, would have encouraged the greater use of CSOP options within the combined regime, especially for those companies which have outgrown, the EMI regime.

The changes made do increase the value of shares which can be subject to a CSOP option, and also broaden the types of company which can grant CSOP options. However, the tax advantages, at least in relation to capital gains tax, have been eroded by a reduction in the annual personal exempt amount. The Chancellor could also have preserved the attraction of CSOP options, in particular for lower-paid employees, by targeting an annual exemption from CGT of, say, £12,000, so as to maintain the position in which option holders realising gains of that amount did not pay CGT.

To What Extent Will The Legislative Changes Make CSOP Options More Attractive To Companies?

The changes which have been made are to be welcomed as a step in a right direction. However, these changes, and indeed certain aspects of the regime which have not been changed, mean that there are still limits on the attractiveness of the CSOP regime. As it stands:

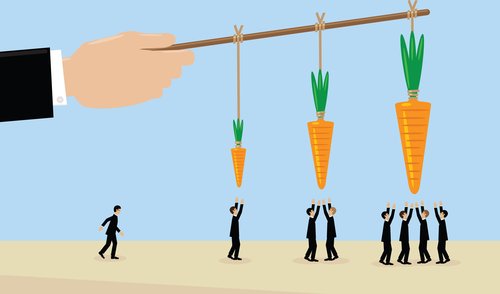

- The individual limit, of £60,000, is widely regarded as too restrictive to allow companies to make best use of CSOP options as an incentive for the retention and motivation of the more senior employees to whom such options have traditionally been granted. However, some companies may look again at whether it would be appropriate to deliver at least a portion of their executive variable remuneration via a CSOP option to maximise after-tax value;

- The “market value” requirement in relation to the setting of the exercise price, and the reduction in the annual CGT individual allowance, from £12,300 to £6,000, significantly reduce the attraction of CSOPs relative to unapproved share options to which such limitations do not apply (but which attract income tax and NICs on exercise, regardless of whether the shares acquired are then, or can be, immediately sold);

- The changes do now enable CSOP options to be granted over so-called 'growth shares' which may allow optionholders to benefit from disproportional growth in value of the company if, and only if, specified value hurdles are achieved. By structuring such hurdles as inherent rights, as opposed to “restrictions”, it is possible for companies to secure agreement with HMRC SAV to initial unrestricted market values of shares within the £60,000 limit on a basis which will afford meaningful incentives to be granted to executives of private companies.

Some commentators have suggested that allowing the grant of CSOP options over a specially-created class of employees’ shares, with restrictions on transfer and possibly limited or differential rights to participate in ‘exit values’ and distributions will make CSOPs suddenly more attractive to private-equity backed companies.

However, there remains the difficulty of determining if a company of which the shareholders include venture capital or private-equity funds satisfies the independence requirement. The problem is that of identifying the beneficial owners of the fund(s) and being able to prove that the company is not under the control of another body corporate. While HMRC appears to accept that an LLP is not a body corporate for this purpose, it is always necessary to check if any corporate partner has de-facto control of the company. Furthermore, such funds are likely to comprise Limited Partnerships with a corporate general partner (or a general partner under the control of a body corporate) which will have control of the shares held by the fund. The statutory test of 'control' for these purposes is complex if partnerships are part of the ownership structure (although not as complex as for EMI options to which a different independence requirement applies).

It remains to be seen if companies which are not qualified to grant EMI options and which have private-equity or venture capital investors, but still meet the independence requirement, will now establish CSOPs for the benefit of key executives, and possibly to allow the grant of tax-favoured options more widely amongst the workforce.

Regrettably, the fact that, having given with one hand, the Chancellor has also (by reducing the annual exempt amount) taken away with the other, is likely to reduce significantly the attraction of CSOP options for those companies unable to grant EMI share options but which have used CSOP options to allow employees (including lower earners) to benefit from growth in value of their employer.

The Chancellor now has an opportunity to re-think and amend the Finance Bill so as to restore the annual exempt amount as it applies to gains on sales of shares acquired pursuant to CSOP options, and thereby increase significantly the attraction of CSOP options for companies unable to grant EMI share options. Many of them have used CSOP options to allow employees, including a large proportion of lower earners, to benefit from growth in value.

…………………………………………………………………….

About The Authors

David Pett is a senior barrister and a ‘share plans lawyer’ who has been ranked as a ‘leading expert’ in the Chambers and Legal 500 directories of law firms. David is author and joint editor of “Employee Share Schemes” (the two-volume loose-leaf textbook, pub. Thomson Reuters) and author of a number of works on share schemes and employees’ trusts, including the original “Practical Guide to Employee Share Schemes”. David sits on the Steering Committee of the Esop Centre, and is currently a Barrister at Temple Tax Chambers.

Suzannah Crookes has worked in corporate tax advisory roles for a number of major accountancy and international law firms, and has extensive experience advising UK and overseas companies on the introduction and ongoing operation of their share plans and other equity incentive arrangements, both at executive level and for the wider workforce. She sits on the Steering Committee of the Esop Centre; is actively involved with the Global Equity Organisation. Suzannah is currently a Legal Director at Tapestry Compliance.

References

[1] EMI options, whilst restricted to smaller high-growth companies, have a greater individual limit (of £250,000) and have no restrictions upon the exercise price which may be set.

[2] If there is an exchange of CSOP share options upon a takeover or change of control on or after 6 April 2023, the shares over which the new options are granted may, to qualify for the favourable tax treatment, likewise be over a class of shares which are not necessarily “employee-control shares” or “open market shares”.