Time to Reintroduce UK War Loans?

Monday, 24 March 2025By Robert McDowall

In response to seismic changes in the World Order, the UK, alongside most jurisdictions in Europe, is examining how increases in defence spending should be funded in order to bring defence spending up to and over 3% of National GDP. Recently, in response to this challenge, the UK has made large cuts to Overseas Aid - with predictable protest and criticism.

Within its current self-imposed fiscal constraints, which have seen major tax increases, the UK finds little room for other immediate sources of funding for what is expected to be higher long-term funding for Defence.

The most elegant and proven approach would be to take Defence funding outside of the current fiscal restraints by means of issuance of Defence Bonds.

These bonds could be considered to be analogous to War Loan Bonds, which are hypothecated exclusively to defence spending. Hypothecation would ensure that HM Treasury could not indulge in internal borrowing, where funds are lent or allocated to other HM Government spending departments- a well-honed historical HM Treasury wheeze.

Interestingly, as the EU faces a future world with less support for NATO from the USA, five EU countries - Germany, France, Italy, Spain and Poland - have given their backing to a proposal on joint European defence bonds which aim to bolster the bloc's defence industry.

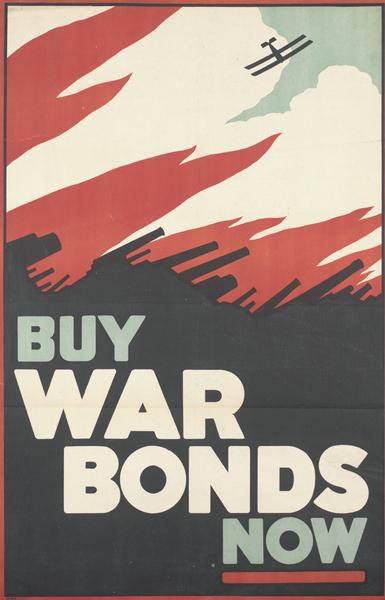

War bonds are well developed debt instruments issued by governments as a means of borrowing money to finance military spending during times of war. A war bond is essentially a loan to a government.

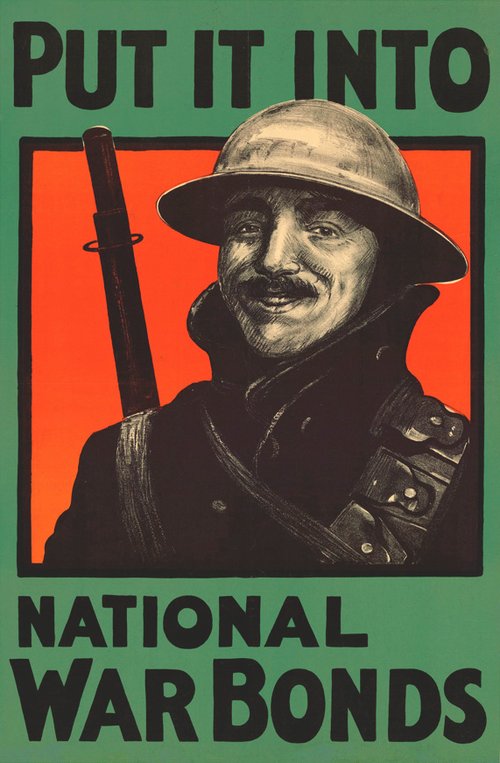

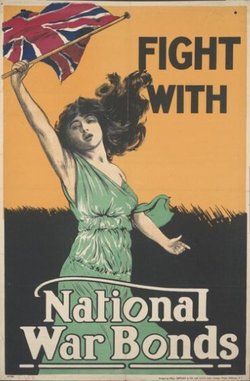

War bonds enable issuing governments to raise money to fund military campaigns. Historically, Governments that issued war bonds sought to appeal to patriotic feelings to sell the war bonds, allowing them to offer a yield lower than market rates. They can also be used to reduce inflation by removing extra money from the economy- although perhaps for the time being that opportunity has passed?

The bonds were sold below their face value. Accordingly, investors paid less than the face value initially and were paid the face value amount at maturity. In other words, war bonds were considered zero-coupon bonds because they didn't pay interest payments throughout the year or coupon payments. Instead, investors earned the difference between the purchase price and the face value of the bond at maturity.

War Loan have a long history in UK financial Markets. National war bonds, which paid out a rate of interest of 5%, were issued in 1917 as the government sought to raise more money to finance the ongoing cost of the first world war. The bonds were sold to private investors with the advertisement: “If you cannot fight, you can help your country by investing all you can in 5 per cent Exchequer Bonds ... Unlike the soldier, the investor runs no risk.”

The government repaid the outstanding £1.9bn of debt from these War Loans on 9 March 2015.

Defence bonds provide a portfolio with indirect access to the defence sector:

- The defence sector will provide increasing financial stability, even during economic downturns. Governments will be allocating a significant portion of their budgets to defence spending, which provides a steady stream of revenue for defence companies.

- Global security concerns have escalated, as evidenced by the geopolitical tensions in Ukraine and Israel, and governments must continue investing in defence capabilities.

- Defence is heavily exposed to technological advances, as it is often at the forefront of technological advancements. Defence companies invest heavily in research and development to develop cutting-edge technologies like cybersecurity, artificial intelligence, and advanced weaponry. Investing in the defence sector allows investors to participate in the growth potential of these innovative technologies.

- As countries modernize their defence capabilities and adapt to new threats, defence companies will likely benefit from sustained demand for their products and services.

In summary, issuance of defence bonds provides a much more elegant flexible and proven mechanism for raising money for increased defence spending, which can be accessed by institutions and retail savings mechanisms.