The Design & Operation Of Collective Defined Contribution Pensions

Wednesday, 03 January 2018By Con Keating

This article is a companion to my formal submission to the Parliamentary Work and Pensions Committee’s Inquiry into Collective Defined Contribution pensions. It deals with some of the more important technical aspects of these arrangements, and may be regarded as completing that submission.

Today’s information technology can enable everything described in this article, and do so extremely cost-effectively.

No pension scheme can be sustained if it operates inequitably among its members. This observation motivates the development of a metric for a member’s equitable interest for use with CDC schemes, and with that the aggregate interest in the assets held by a scheme. A defining characteristic of these schemes is that they have no explicit liabilities, and consequently can have no contractual recourse to external guarantors or insurers based in whole or part on metrics driven by liability values.

The problem reduces to a schema which accurately captures the interests of each and every member while also encouraging solidarity among those members. Through collective risk-sharing and risk-pooling, it should provide explicit benefits to members and offer an incentive to younger non-members to wish to join the scheme. With CDC, a member’s equitable interest reflects their proportional interest in the assets of the collective at any point in time. It is an equitable scheme of arrangement among members.

It turns out that the uniform award structure of traditional DB arrangements does precisely this. It does so through the contribution setting mechanism and embeds this into the scheme. This is the mechanism, in traditional DB, whereby the contribution for a year of service confers an entitlement to some defined accrual, say 1.5% of final salary, regardless of the age of the member. With CDC schemes, this “entitlement” is a best efforts endeavour, not a contractual commitment.

Of course, many other possible schemes of arrangement for determining their equitable interest may be acceptable to members, but this uniformity of award regardless of the member’s age has the dual advantage of simplicity and familiarity from prior use.

Tracking the contributions of members and their associated investment returns is a particular scheme of arrangement. It is one in which members commingle their contributions into a common fund, but have no other risk-pooling or sharing; their claim and its likely outcome is little better than that of an individual DC saver.

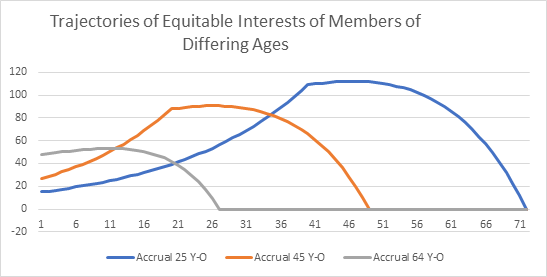

The combination of contribution and projected benefits payable defined the award’s contractual accrual rate (CAR), which may be thought of as the rate of return expected on the contribution received. Together these define the trajectory of the member’s equitable interest over its lifetime. This is illustrated below for members aged 25, 45 and 64.

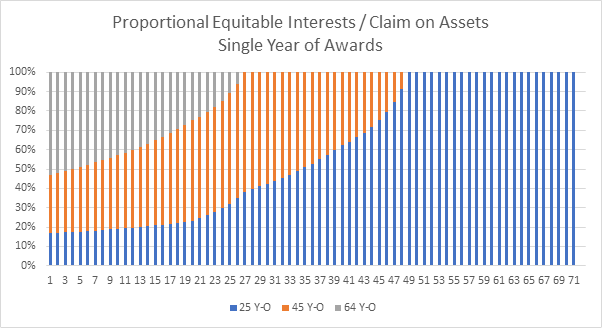

The equitable interests of members, in this single award illustration, in the assets held by the scheme are simply their proportional shares of the total outstanding interests of all members at a point in time, as shown in figure 2. In turn, this means that transfer values and drawdown under Freedom and Choice may be facilitated. While encashment by members with short life expectations is a potentially costly moral hazard, it turns out that the behavioural anomaly that individuals under-estimate their own life expectation dominates, leaving the scheme on balance better funded, after transfers, for those that remain.

The process of setting a contribution rate for a new award by the trustees needs to take account of two things. First it needs to consider the alternate investment opportunities available to members for their contribution, in order to assure that the scheme offers value for money to members, and second, it needs to consider the investment return that the scheme may achieve. This latter rate will usually be higher than the former.

It may prove to be the case that when return expectations are low, and the required contributions high, that the employer is unwilling or unable to make those contributions. The sponsor may even have an agreement in place that it may pay no more than some specified rate, say 18% of pensionable salaries. In this case, the trustees should lower the accrual awarded for that year, from, say, the earlier suggested 1.5% to say, 1.0%. In this it differs from traditional DB, where changes such as this are infrequent, and usually apply to all future accrual awards.

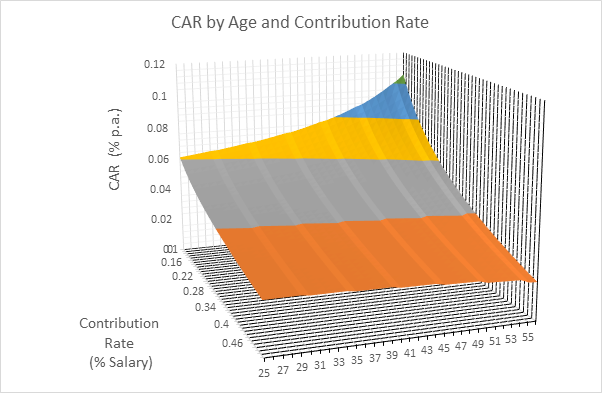

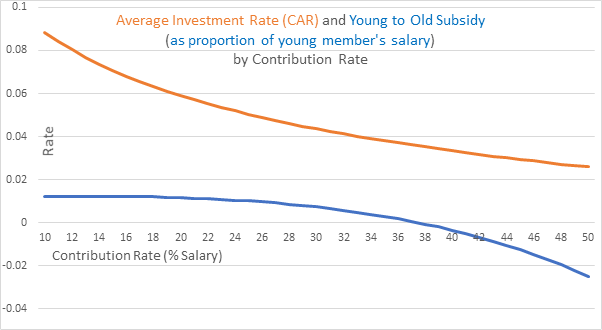

While this is a cut in the benefits ultimately to be paid, it is known in advance and members could, if they wished, increase their own contributions to compensate in whole or part.

The uniformity with age introduces risk-sharing among members. The differing times to retirement imply different investment accruals (or different contractual accrual rates -CARs) which vary with age. This is illustrated as Figure 3. The corrugations evident in this figure are a product of the granularity of increases in life expectations in this simple model. When expected returns are high, and contribution rates low, younger members achieve lower than average returns while older achieve higher. By contrast, when expected returns are low, and contributions high, younger members achieve higher than average returns, and do so over the entire life of the award, while older scheme members experience lower than average returns. This arrangement is true risk sharing, not some intrinsically inequitable subsidy. It fosters solidarity among members as it represents a form of mutual insurance.

While this phenomenon is present in traditional DB arrangements, it is rendered immaterial to members by the sponsor guarantee.

The magnitude of this effect between the oldest and youngest members of a scheme, by contribution and average contractual accrual rate is shown as figure 4.

The assumptions which drive the pension payment projections may be updated from time to time, as experience informs the calibration of those values.

The proportional equitable interest of a member defines the share of scheme assets attributable to that member, and with that transfer values. The value of scheme assets as a proportion of the total of members’ equitable interests is an analogue to the funding ratio in traditional DB; it is the equitable value’s asset cover.

The further benefit of this award structure is that it provides what is effectively a default drawdown or annuitisation schedule. When combined with the equitable asset cover, members may obtain directly the funded pension value and income equivalent of their interest at any point in time. This removes the point in time uncertainty of annuity purchase on retirement associated with individual DC arrangements. It also provides an accurate reference for the calculation of annual and lifetime allowances.

Importantly, it removes any need for the individual to de-risk their portfolio as retirement approaches. Historically such a shift has been very costly; since 1980 risky assets have outperformed safe assets by approximately 3% pa, or put another way, de-risking has halved the post retirement investment returns.

There are further risk management options available in CDC arrangements; these depend in turn upon the precise form of the pension “promise”. Two immediate distinctions are important, which I will describe as Cdc and Cdb. With Cdc the member has access to the full value of the asset fund, in other words the individual may achieve outcomes higher than the pensions “promise”. While with Cdb the member receives at most the “promised” pension, with surpluses being retained in the fund.

In the case of Cdc, there is no further risk sharing with others. If the scheme is in deficit at the point in time that a particular pension payment is due, then only that pension covered by assets will be paid. If the payment of a particular amount of pension is desired by the member they may borrow from their residual equitable interest, should that permit that. The member is merely spreading the risk over time. Such an action reduces their residual equitable interest.

In the case of Cdb, there may be further risk-sharing among members. If the scheme is in deficit, then the full pension promised is paid. At the same time, the equitable interests of active and deferred members are adjusted upwards by an equivalent amount. There are limits to this ex-post risk-sharing, which are discussed later. This has the effect of increasing the magnitude of both the total equitable interest and active and deferred members’ relative interests in the scheme asset pool. With Cdb, the member opting for transfer is entitled to the level of asset coverage subject to a maximum of their equitable interest, which of course, is the pension “promise” value.

It should be recognised that these transfers are small in the context of the fund. If we consider a scheme where pensions payable are 5% of the value of the fund and the scheme equitable interests are 80% covered, this adjustment is only 1.25% of the fund value. This is well below the level of uncertainty associated with pension projection parameters and indeed the confidence intervals of expected return judgements. This is effectively a 1% addition to the total equitable interests of pensioners and a 1.67% increase in the individual interests of active and deferreds. It is of the order of 2-3 basis points in the realised investment return. It is a small fraction of the annual variation in asset portfolio values. This is considered more fully later, when considering when pensions may need to be cut.

This latter representation should make evident the flexibilities that arise from the ultra-long nature of a co-operative member mutual scheme, and the time that this affords trustees to identify and if necessary, rectify persistent imbalances, or mis-estimations. The emphasis on annual sufficiency, rather than deficit repair and precautionary actions, is not incidental; it is a reflection of the going concern nature of the member mutual enterprise. The question of sustainability is simply a matter of treating all members equitably and offering value for money consistently.

Another way to regard CDC schemes is as traditional DB minus the sponsor guarantees, which as guarantees are costly, should result in superior outcomes for members. The question of hedging the true risk factors, longevity and inflation, expands from the cost benefit question whether they should be hedged to the wider if and when. Bear in mind that increased longevity results in a very remote cash flow cost, while inflation’s effects are immediate.

It is, however, clear that the costs of hedging these risk factors, as well as the uncertainties in returns expectations should be a fraction of that now evident and associated with the sponsor guarantee. The cost of the sponsor guarantee expresses itself through several channels; through explicit deficit repair contributions, through overly cautious asset allocations, through depressed wage growth, and arguably, through the social costs of the cessation of provision.

It is growing increasingly clear that new analytic methods, such as machine learning and artificial intelligence, hold the prospect of improving considerably the speed of identification of persistent departures from expectations and the formulation of more precise and accurate expectations.

So when should pensions be cut in a CDC arrangement? Or equivalently: how much risk to members’ pensions is there in mutually offered funded pension?

The setting is the DB type pension (Cdb) of some fixed proportion of, say, final salary. Typically, for mature schemes these represent amounts which are normally in the range 3% - 5% of scheme assets. Obviously if scheme assets fully cover proportionally the equitable interest of pensioners, then no cuts are necessary. This is clearly a “going concern”, in good health.

We would also note that balance sheet insolvency is not a binding constraint (nor is it illegal to operate a balance sheet insolvent company), but the inability to meet a payment due, cash flow insolvency is binding.

If the assets of the scheme do not fully cover the equitable interest, then the pension payment would be at risk, but at this point, a risk sharing agreement comes into play. The pension payment is made in full – the top-up being “provided” from the assets attributable to other non-pensioner members of the scheme. In any year, the amounts of this top-up are quite modest. To illustrate this let us consider a scheme which is 80% funded, the equitable interests of pensioners are 40% of the scheme total and pensions amount to 5% of the value of assets. As earlier, the top-up, or transfer among members, is just 1% of the total equitable interest, or 1.25% of scheme assets. Even if the deficit or shortfall is 50%, the transfers only amount to 2.5% and 3.13% respectively. As was noted earlier, this transfer of assets triggers a reciprocal and compensating increase in the equitable interests of non-pensioner members.

Now the first problem that needs to be addressed by trustees concerns the cause of the deficit which led to the insufficiency. Has this arisen from a fundamental misestimation of the implicit investment returns available or is it simply the result of the transient “animal spirits” of markets, and likely to self-correct. Clarification of these issues gives rise to the need for a forbearance period, during which the risk-sharing mechanism will operate. Clearly that mechanism needs to be related to both the magnitude of the deficit and the resultant support transfer.

The straw man offered is that a 10% deficit should admit a ten-year forbearance period, a 20% deficit five years, and 50% just two. Some further rules are needed to allow for sequences of deficits. Increasing deficits shortens the forbearance period, so a 20% deficit has a five-year forbearance period and if this increases in year one to 50% the forbearance period shortens to just two years from that date. Some clarification of the rules is needed to accommodate partial recoveries; suppose that the 50% deficit shrinks to just 20% in the first year, then the forbearance period becomes five years, but the clock started the year previously, leaving just four years of ongoing forbearance.

If a scheme is still in deficit at the end of this forbearance period, then the pension payable is simply the funded level of the pensioner members’ equitable interests. To avoid an actual cut, the pensioner may choose to borrow against, or bring forward, some of his or her residual equitable interest. If and when the asset coverage of the scheme recovers, the cuts imposed will be restored, but doubtless some members may have died in that interim.

If payments to pensioners are cut, so also, and to a similar degree, are the equitable interests of non-pensioner members.

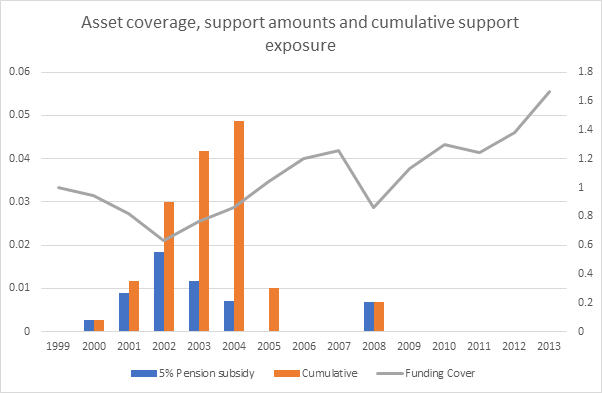

There is also the issue of the amount of their equitable interest that non-pensioner members might be happy to risk in support of pensioners. This is constrained also by the possibility that excessive support would reduce the asset pool to a level from which recovery is not possible. A level of 10% of the non-pensioner members’ equitable interest seems plausible, particularly when it is understood that this is a maximum exposure. Figure 1 below examines the support payments for a scheme paying 5% of (initial) assets in annual pensions. The scheme has a contractual accrual rate (CAR) or expected investment return on assets of 5.5% pa. The evolution of asset portfolio is shown for the period 1999 – 2013. This period captures the worst experience of the 1899 -2015 period – it is an all equity UK index portfolio with high volatility. In fact, the likelihood of a sequence as poor as that observed, between 2000 and 2002, is less that one in a thousand. The asset coverage level is arbitrarily set to 1 in 1999. The asset coverage of the total equitable interest falls to a low of 63%, implying that significant cuts would otherwise be appropriate.

The largest level of support in any year amounts to 1.83% out of the total 5% payable. The cumulative support over the five years of deficits reaches a maximum of 4.87%. This is 8.1 % of the non-pensioners’ equitable interest, when these members account for 60% of the scheme.

Put another way, in this the worst experience of any period since 1899, it was unnecessary to cut pensions in payment.

More sophisticated analysis, allowing for the reciprocal increases in non-pensioner equitable interests, and the modified shortfalls arising from that, increases the cumulative support to 5.42%, which is 8.38% of the non-pensioner interests.

By supporting pensioners over this period when scheme asset coverage would not otherwise merit this, non-pensioner members have increased their equitable interest, their pension “entitlement” by a total of 9.67%.

Extensive simulation of the scheme and this 10% support for pensioners indicates that it only becomes necessary to cut pensions in payment in less than one case in a thousand. In no case, does this level of support result in an irrecoverable “death spiral”.

This differs from other simulations, where much higher cut rates are evident. This difference arises from the fact that those models have extremely volatile, capital market consistent, pseudo-liability values while here the equivalent, the members’ total equitable interests exhibits a smooth progression as time unfolds.

The presentation to scheme members is simple. If you place at risk of partial loss, 10% of your equitable interest in the scheme in support of pensioners, you may expect to enhance your own pension outcomes by a similar or larger amount.

Understanding of this point makes it clear that rather than promoting inter-generational unfairness, risk-sharing in CDC actually promotes inter-generational solidarity. It also demonstrates that these are not just rebranded “with profits” policies as there are no equivalent mechanisms or incentives within those.