Initial Coin Offerings (ICOs): The Search For The Final Function [fraud in cryptocurrencies]

Friday, 12 October 2018By Ian Dowson

ICOs, Blockchain and Distributed Ledgers

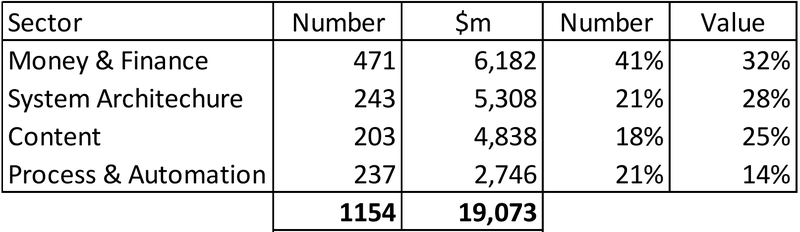

ICOs (Initial Coin Offerings) are the latest extension of the Blockchain, Bitcoin ecosystem. Recent research by William Garrity Associates indicates that since emerging in March 2016, 1,154 projects have been launched with a gross value of $19bn. Around 40% of these projects have tradable coins. The amount of external third-party cash that has been placed into projects cannot be externally verified, but could be in the range of $2bn to $6bn (10% to 30% of the total). The cumulative traditional funding of Blockchain and Bitcoin business models is around $3.8bn.

The spur to develop ICOs was the 2015 release of the Ethereum distributed computing platform with integrated scripting. Ethereum based projects came second only to Bitcoin in value, but other platforms are beginning to challenge as XRP-Ripple competes with Ethereum in value and others such as EOS, Stellar and Litecoin further extend the cryptocurrency ecosystem.

Many arguments have been raised around the legality of coins and tokens against current securities laws. How can an electronic coin or token without a governance system ever become a means of exchange, store of value or unit of account? Cybersecurity is not as advertised by proponents. Each month there are thefts reported valued in $millions. The concern over the integrity, security and validity of tokens and coins is recognised however, our focus is to examine the underlying business models of launched projects - the function of ICOs. These business models are highly creative, flipping many conventional models, they raise the possibility of the emergence of a new form of economic networked connectivity combined with a mechanism of mutuality inherent in tokens and coins, binding all participating parties together to ensure the network thrives.

ICOs to September 2018

The growth of ICOs has been strong over the first 9 months of 2018, seeing the establishment of 780 projects (with a combined gross value $12.7bn) which is more than double the total issuance of 2017 (355 projects with a gross value $6.1bn). On the assumption of a 10% to 30% external cash raised ratio, $1-$4bn could have been raised in 2018, compared to traditional funding of Blockchain and Bitcoin 2018 (which from January to July saw the establishment of 80 projects valued at $1.4bn).

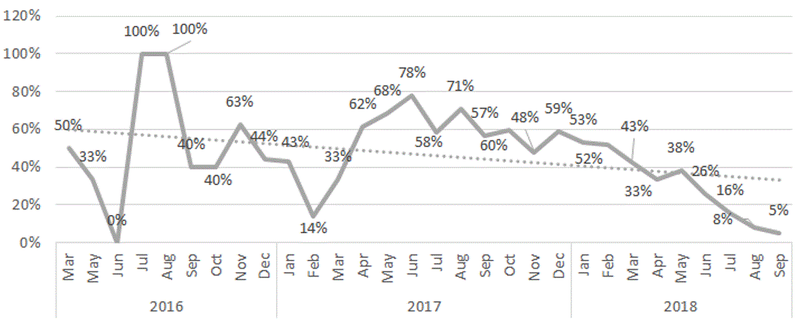

Tradable Coin Tokens Observed, % of ICOs

sNote: March - September 2018 percentages are lower than average, there usually is a time delay between the ICO closing and the issuance of coins/tokens.

Business Models

The Business models of ICOs give an insight into a new stream of economic potential - they go far beyond the process efficiency and STP (straight through processing) gains of existing blockchain models. ICO business models use the underlying technologies of blockchain and distributed ledgers, as identity, trust and recording mechanisms. They add a series of application layers enabled by the software core including:

- P2P (peer to peer) connectivity

- Network creation and discovery

- Process automation

- Place and provenance mapping

- Security and privacy;

These sit on top of existing payment, asset management and value transfer exchange functions and can exist within open or curated networks. These business models are experimental "minimum viable products" which are probing the world’s finance and business systems for traction points.

The flipped business models of ICOs, turn existing business value creation propositions upside down:

- ICT asset utilization in B2B environments. The creation of virtual cloud computing environments by companies pooling their servers and selling unused capacity at scale, could create cloud computing facilities the size of Amazon Web Services. This is not fantasy computing - the BitTorrent network is an example of how virtual networks can be created.

- Advertising. you, the consumer, could get paid for watching content and advertising, gaining loyalty bonuses and points, if these become globally tradable you could sell your future content consumption in a futures market.

- Tokens and coins. The use of coins and tokens to create mutually economic beneficial relationships between producers, consumers and platforms could result in viral economic ecosystems, which would become self-fulfilling propositions through coin appreciation, thus achieving scale and dislodging existing market leaders - it’s interesting to note that Airbnb has expressed a wish to issue equity to its hosts.

The four main areas of business model by type:

Money and Commerce

This is the largest ICO area for investment at $6.2bn. Finance, with 160 projects is the largest, followed by Trading and Exchanges with 99 projects, and Payments with 94. These projects continue the disintermediation process found in earlier FinTech models, but combine this force with the networks, straight through processing, and automation capacities of Blockchain and Distributed Ledger Systems. The real prize is data in real time, available at any part of any process. New forms of network centric and adaptive banks, insurance value chains and exchanges could emerge from these models.

System Architecture

ICO business models are designed to reconfigure and improve the original platform templates which were established by Bitcoin and Ethereum to shape how Blockchain, Distributed Ledger, Coin and exchanges operate. ICO models offer alternative consensus mechanisms, lower energy consumption and faster processing speeds.

Core Architecture, Platforms and Software are the largest single investment sector of all of all ICO projects, totalling $3.2bn over 148 projects. Communications and Storage has $1.5bn investment into 51 projects, and AI is just emerging with $281m invested over 21 projects. Above all, AI investment has the capacity to take blockchain system architecture capacity to another paradigm, moving towards self-regulating, adaptive systems.

Content

Content's largest segments are Social Media ($2bn) and Advertising ($1.1bn). Social media investment is skewed by a $1.4bn pre-ICO tokenisation undertaken by the Telegram social messaging network. Advertising models use the capacities of blockchain to grab the same straight-through processing efficiencies as Finance. Content models aim to monetise content-disintermediating, traditional agency publishing models, in an encrypted rights protected environment.

Process

Although smallest segment in financial terms, some of the most interesting business models are found here. Healthcare, Gambling and Recruitment are the largest subsectors. Healthcare focuses upon the straight through processing and security aspects of Blockchain and Distributed Ledgers. Gambling uses process efficiencies but is probing viral network connectivity to develop new formats of P2P gambling in areas such as eSports. Recruitment models use the privacy, encryption and payment capacities to enable users to network skills into the best employment markets.

ICOs use Network Impact

When Tim Berners-Lee developed hypertext and the world wide web he reconfigured existing components (Network Topology) of global telecommunication’s networks in a manner that enabled a new way of communication and data transfer to occur. Many ICO business models are based upon the theories behind Network Topology - but instead of reconfiguring data, they reconfigure business models with built-in network scale and reach.

Potential for Business Model Traction

This burst of ICO business models cannot be taken in isolation. A mere 12 months ago, it would have been considered fanciful to suggest that new network centric business models could challenge existing social media and traditional financial services giants. The context has now dramatically changed. Privacy, security and trust issues have come to the fore. We are bombarded by media reports which highlight data security breaches or misuse of data. "Big Tech" is being painted as evil. Its models and their management are under pressure. Could the era where the consumers data is the product be on the wane?

The developing and emerging world, a third of humanity, does not have embedded infrastructure or the security of governed networks. As a result, the propensity for viral change at scale is high, as illustrated by the growth of mobile phone banking.

These forces create a window of opportunity for ICO funded business models which, by their form, disintermediate previous funding mechanisms. As in all business models the questions are - do they meet consumer or business needs? Can they scale and monetise and devise marketing systems? These ICO prototypes are now being tested against their markets.

Conclusion

In itself, the emergence of 1,100 plus ICOs, disintermediating existing financing channels and creating a new form of economic entity, would be remarkable. Have no doubt there are major concerns over governance of these models. Fraud has been prevalent. Many have management teams with no or little skill of implementation of any form of business plan. How the funding process and coins and tokens fit within existing securities law is also an open question.

ICO business models are built upon three pillars:

- A further evolution of Fintech disintermediation forces;

- More effective platforms, and;

- Two massive POC (proof of concepts) Bitcoin and Ethereum.

The world awaits to see if ICO business models can create another reinvention of the world wide web as profound as its genesis in 1991 by Tim Berners Lee, who announced on 28 September 2018 he will be working with Solid Platform so that applications can be built that give users choices over use of their data.

Ian Dowson is Principal of William Garrity Associates Ltd a boutique consultancy which focuses on the strategic implications of innovation specialising in FinTech (Financial Services Innovation), GovTech (Government Digital Transformation) and Corporate Development projects around company disposals. He has been producing original research on FinTech innovation ecosystems since 2011 and researching the forces driving the startup ecosystem in London since 2008. Ian mentors a number of Startups.

©IC Dowson & William Garrity Associates Ltd 1/10/2018 all rights are reserved. Trade marks are acknowledged as property of owner. Nothing in this content forms any kind of investment advice or endorsement of ICOs or Cryptocurrencies.

Note that Ian Dowson's estimate above, i.e. approaching 60% of ICOs not producing a traded coin, is in line with a Boston College study examining 2,390 ICOs that determined only 44.2 percent of startups survive after 120 days from the end of their ICOs.

Benedetti, Hugo E and Kostovetsky, Leonard, Digital Tulips? Returns to Investors in Initial Coin Offerings (May 20, 2018). Available at SSRN: https://ssrn.com/abstract=3182169 or http://dx.doi.org/10.2139/ssrn.3182169

Related Pamphleteer – “The London Token Fundraising Manifesto”, Michael Mainelli (24 October 2017).