Defined Benefit & Collective Defined Contribution

Wednesday, 25 October 2017By Con Keating

With Labour calling for completion of the unfinished legislation necessary to introduce collective defined contribution schemes, the usual suspects emerged to decry the concept. Their position really has to be one of wilful blindness given that the most elementary analysis of the institutional structure shows their criticisms to be baseless.

The critical characteristic of a DB scheme is that the employer sponsor underwrites an implicit return on the contributions made by both employer and employee. This is the rate which is needed to be earned to deliver the projected benefits promised. Shortfalls in asset performance relative to this rate result in scheme deficits.

The cure of such deficits is the sole responsibility of the sponsor – as indeed are surpluses. The vested benefits of members are unalterable. The scheme may call only upon the sponsor. The pricing of new awards, rare though they now are, should not include any element of past shortfall repair. It is possible to vary this basic position, but that would require explicit member consent – it appears never to have been done in the UK.

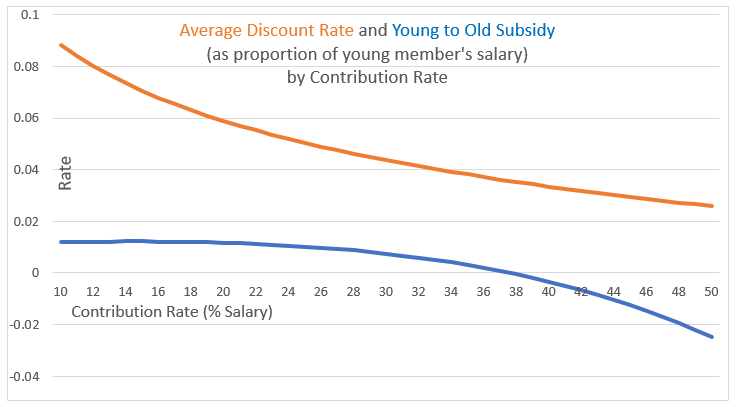

Among the rhetoric and invective is the claim that collective schemes are inter-generationally unfair, and that younger members are profoundly disadvantaged. In both DB and CDC, the uniformity of the contribution rate, and the common accrual for a year of service are intra-generational risk-sharing. They are not systemic transfers from one class of member to another. The diagram below shows the amount of transfer between the oldest and youngest active members of a collective scheme for a range of contribution rates. It shows clearly that the arrangement is risk sharing, not cross-subsidy. It also shows the average discount rate associated with a particular contribution rate.

It may help to understand this phenomenon by considering the proportion of the pension ultimately payable that is simply a refund of the contribution made. In the case of a 10% contribution rate, this is 3.5% for the young member and 15.9% for the elder, but when the contribution rate is 50%, it is 17.7% for the young member and 79.5% for the elder.

In the sense of the workforce, this arrangement is intra-generational; in a time-serial setting it is a question of overlapping generations. It is not inter-generational in nature.

However, in a defined benefit arrangement this collective pooling and sharing arrangement is immaterial to the scheme member; their pension benefits are fixed. The sole risk that they face is that of sponsor employer performance under the underwriting guarantee, and practically this reduces to sponsor insolvency.

In a CDC arrangement, there is no sponsor underwriting guarantee; this role is assumed by the members collectively. There is no meaningful concept of sponsor insolvency here, as this is a case of members collectively owing a debt to themselves. The collective does now face investment, inflation and longevity risks. Unlike DB, CDC scheme trustees have a role in managing these risk exposures. The risk-pooling and sharing properties among members become relevant. Unlike DB, where the sponsor employer is usually the residual claimant, these trustees have a singular responsibility to beneficiary members.

Should deficits arise, it is not practically feasible to call upon members for repair contributions; collection of such calls would be profoundly problematic given the varying circumstances of members. In addition to repair through the risk channels, investment, inflation and longevity, the benefits attributable to members may be varied. In the latter case, varying benefits in proportion to a member’s accrued claim would be equitable. It should also be realised that any such variation can be achieved, with considerable flexibility, by utilising the time dimensional properties of the scheme. After all, the scheme is simply a reflection of the collective consumption preference of members over their life-times.

The annual pricing of new award contributions is a matter for negotiation between the scheme and employers. Where a long-term contribution rate has been agreed with sponsor employers, this may be accommodated by either variation in the implicit discount rate or variation in the terms of award. New award pricing may contain elements of deficit repair, but it is important that this should be arranged in a manner which is equitable among all members. This applies equally to those entering the scheme solely for the purpose of using it as a decumulation arrangement.

The one thing which is patently obvious is that the mutuality of a collective defined contribution schemes is viable, and that we can expect from them delivery of attractive pension benefits over the long-term.