Accounting Issues For Central Bank Digital Currencies

Tuesday, 13 October 2020By Robin Darbyshire

Amidst the extensive range of publications on the topic of Central Bank Digital Currencies (CBDCs), there has been little discussion of the accounting issues, both for the central bank itself and for potential users.

This is perhaps because the topic is rather technical and mainly of interest to accountants in central banks. However, the accounting issues are of significance to both the Central Bank and to users. Indeed, the accounting treatment of the CBDC may impact on its acceptance and use by the public.

This paper sets out some accounting issues for both the central bank and users. It may therefore be of interest to accountants working in central banks, who may be asked for their views as to how a CBDC would be reflected in the CB’s own accounts. It also sets out issues for users, which may serve to highlight some points that need addressing by the issuer to aid usage.

The analysis and comments are made with reference to IFRS, as this is the most common accounting framework used by central banks and by many entities around the world. However, the points made may be applicable to other frameworks.

What Is The Nature Of A CBDC

The precise nature of a CBDC is still not totally clear, and there are several possibilities being discussed, including whether the CBDC is for retail or wholesale purposes, and whether the CBDC will be account based or token based. Whilst these are important technical differences, for accounting the differences are less significant and there is a great deal of commonality, especially for the central bank accounting. In particular, the most common underlying feature is that it is intended to be a means of payment for use by the public (whether a limited sector or generally), as an alternative to banknotes (currency) and electronic funds issued by commercial banks[1]. Therefore, for the purposes of this paper it is presumed that the CBDC is largely analogous to banknotes. In particular, the CDBC will be a liability of the central bank in the same way as currency in circulation. It is also worth noting that the other existing form of central bank money, commercial bank reserves, are also liabilities of the central bank.

This approach, whilst practical, is not the only possibility. It is basically treating the CBDC as cash. If the design of the CBDC includes the ability to pay interest (including at negative rates) or make charges for use, this raises questions, as such factors are not common in the traditional forms of cash, ie banknotes and coins, although cash handling charges are levied by some entities. These factors could make the CBDC more like a financial instrument, whose definition in IFRS is a contract that creates a financial asset of one party, and a financial liability of another, and includes a contractual right to receive cash.

The precise definition of a CBDC is of limited significance to the central bank itself, as it is largely a matter of the caption on the balance sheet but is a significance to users. This will be discussed in more detail below. It is worth noting that existing crypto currencies are not regarded as financial instruments.

Accounting In The Central Bank

The basic feature is that the CBDC will be a liability on the central bank balance sheet. This is the same treatment as adopted for banknotes and for central bank reserves. This will apply to both retail and wholesale CBDC and whether the CBDC is token or account based. The balance sheet liability will correspond to the total CBDC issued to the public, that is any user outside the central bank itself. The practicalities of achieving this will depend on the nature of the CBDC. If the central bank does not hold the detailed records of the individual users, the balance sheet will record the net movements into and out of the central bank, to the intermediaries, that is banks and other entities authorised to be intermediaries in the issuance and handling of the CBDC. If the detailed accounts are held at the CB, the balance sheet will be the aggregate of all the individual CDBC in issue.

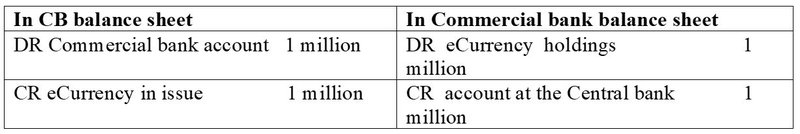

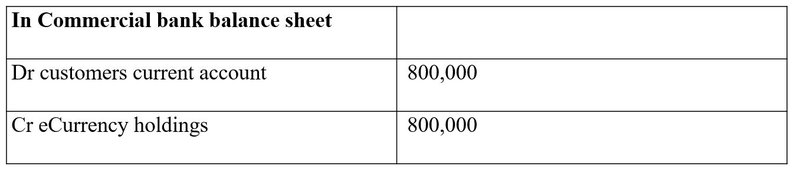

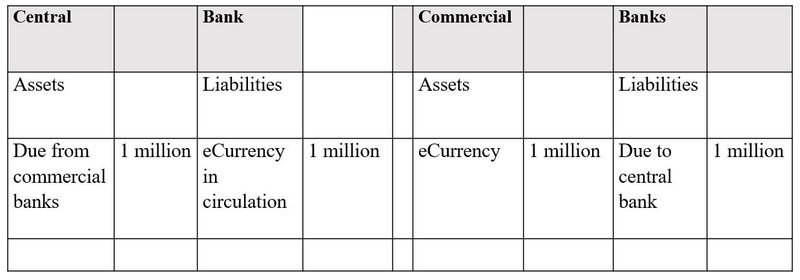

The basic double entry is for using the issuance via a commercial bank as the model[2]. These examples are expressed in the form of debits and credits, which will be readily understood by central bank accountants. A more detailed description is given in an appendix.

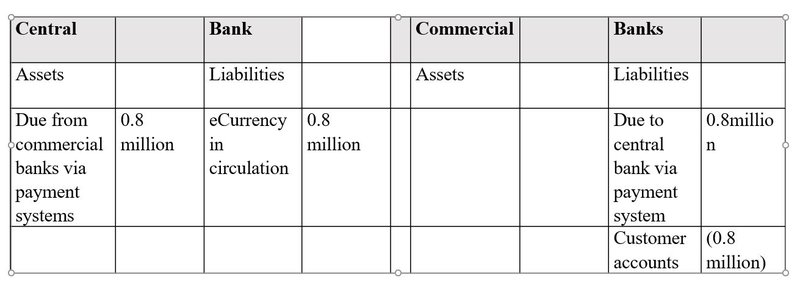

(A) On issuing 1 million e-currency (eC) to a commercial bank for 1 million Local currency (LC). Of which 800,000 is withdrawn by the bank’s customers.

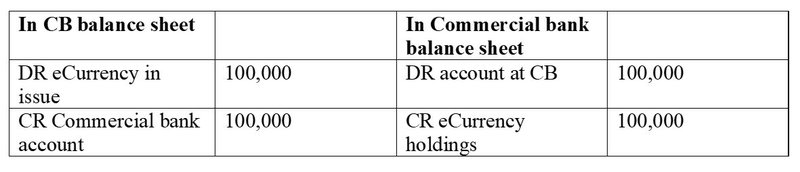

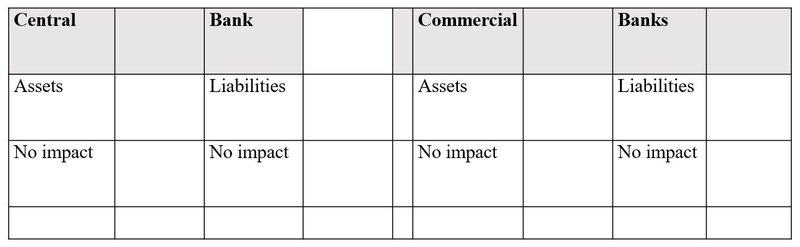

(B) commercial bank returns 100,000 eC to central bank

Note: If the commercial bank is only issuing the CBDC as an agent for the central bank, the transactions will be similar, but the sale of CBDC and the cash transfer will only reflect amounts used by the commercial bank’s currency. The net effect is that CBDC held by the commercial bank is not in circulation.

The central bank may hold some eCurrency itself, for example to make its own payments. Strictly speaking this is not in circulation, so should not be included as a liability of the CB. It is also not appropriate to show this as an asset of the CB, as it is a claim on itself. In practice materiality applies and small amounts may be reflected in the balance sheet. Should the CB decide to create eC in large round sum units, any unissued currency will initially be recorded as an ‘asset’ in the CB records. For the presentation of the balance sheet, any amount held by the CB should be deducted from the total created, in order to give the true external liability of the CB

In this arrangement, transactions amongst the public in eC do not affect the CB and indeed are not recorded in the CB’s own records. In this way the eCurrency is analogous to banknotes. If the CB decides to reflect all transactions in eC in its own systems, with the CB itself maintaining the ledger, the overall accounting effect is the same as described above. The difference is that the liability will be the aggregate of many, perhaps millions, of individual accounts.

Central banks may earn revenue from the issue of CBDC, in a manner similar to that on the issue of banknotes. Such income, known as seigniorage, arises from the assets that match the liability for the currency issued. For banknotes the liability is non-interest bearing and so the income earned on the matching assets, if they are interest bearing, less the costs of issue, such as printing, forms a major part of the income of many central banks. In the case of CBDC, there will also be assets matching the liability, which will earn interest, and so generate revenue. The seigniorage income will be reduced by any interest payable on CBDC. There will also be some costs in administering the CBDC, mainly computer related costs. Such seigniorage will need to be included in central bank income projections, and its treatment for profit distribution agreed. The income on CBDC will substitute for the seigniorage on banknotes, which the CBDC may be replacing.

It is also possible that the Central bank may wish to withdraw some of the CBDC and subsequently cancel it. This could be part of routine replacement, or for other policy reasons. In such an instance, the CB will have initially taken in the CBDC, probably via a commercial bank as in example B. Once the CB has the currency in its possession, it can simply cancel the CBDC concerned. This will not have any net impact on the balance sheet or on the income statement.

In another situation, the Central Bank may decide to cancel some CBDC for other policy reasons, such as if a unit (whether token or account based) has not been used for a long time. This is analogous to cancelling old banknotes. In such circumstances, the cancellation will result in a reduction in the liability and a gain to the CB. This is likely to be quite a rare event. As an indication some CBs have never cancelled their banknotes. However the scenario should be considered and if necessary included in the legislation.

Accounting In Commercial Banks And Other Intermediaries

If CBDC is transferred to the general public in a manner similar to that of banknotes, commercial banks and some other entities will act as intermediaries, buying the CBDC from the central bank and then allowing their customers to withdraw the CBDC (add it to their wallets) in exchange for other funds. So, the CBDC will initially be an asset of the bank/intermediary. As it is withdrawn by customers, the asset will be reduced. The banks will probably hold a stock of the CBDC to meet customer demands but will want to keep this to minimum. Consequently, they may wish to return excess to the central bank. The electronic form and 24 hour operation of CBDC may change this pattern over time.

The classification of CBDC for accounting terms, and regulatory purposes, will be important, as commercial banks have requirements to meet. The most obvious classification is as cash, but if this is not the case, commercial banks will need to adapt, and this may impact the usability and acceptance of the CBDC by banks and customers. There is also the issue of the valuation basis. Cash is basically at face value, however if classified as a financial instrument, the requirements of IFRS to assess the appropriate accounting basis, cash or fair value, applies as does the need to consider expected credit losses. Although this may be fairly straightforward, it is an unnecessary complication.

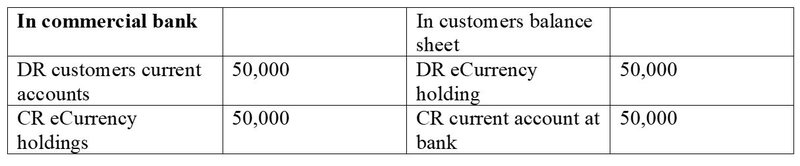

C) Customers withdraw 50,000 CBDC from commercial bank

Accounting Issues For The Public, Including Entities Holding CBDC

For the general public, including commercial and other entities, the key issue is whether the CBDC meets the criteria for being classified as cash. The old adage that ‘cash is king’ is very important. Therefore, it is likely to be important that people are not forced into a choice between accepting cash and CBDC through the accounting classification, or even have their choice significantly affected by this classification. The public does actually make such a choice at present, between differing methods of payment, for example cash, cards or direct transfer into bank accounts. This choice is made by the public on its own criteria and accounting has no significant impact. However, the position is helped by accounting defining cash as including demand deposits, thus giving equivalent accounting outcomes to both payments by cash and bank accounts. Credit cards payments do have a slightly different treatment, but it is normally not of significance in the acceptance of these. Other factors determine the acceptance of cards. In contrast existing cryptocurrencies do not even qualify as financial instruments.

A major accounting difference for non-banks is the significance of the cash flow statement. Although this may be regarded as rather a heretical statement, the statement of cash flows is not normally of major significance to a central bank, and only slightly more to a commercial bank. It is however of major significance to other entities, since cash generation is important in the long term viability of an entity, and users of financial statements place importance on a clear statement of the cash flows of an entity. Any artificial apparent cash flows, due to a choice between CBDC and existing cash, would not be helpful. This would arise if the CBDC is not regarded as cash or a cash equivalent, but is for example another financial instrument,

Accounting definition of cash

The definition of cash in IFRS is in IAS7.6 as cash on hand (physical currency held) and demand deposits. This would seem to exclude CBDC. However, this definition was created before CBDC or indeed any ‘cryptocurrency’ was being actively considered. It may be simplest to amend this definition, but care will need to be taken to ensure that any revised definition did not overextend the coverage. Perhaps a simple practical expedient would be to simply add wording to the effect that physical cash included digital money created as a liability of the authorities.

If this is not possible, then it is necessary to consider other interpretations within the standards. The most appropriate would be as a financial instrument. Under IFRS, a financial instrument is any contract that gives rise to a financial asset of one entity and a financial liability or equity instrument of another entity (IAS 32.11). It would seem that CBDC would meet this definition but is there a contract? The legal act that forms the basis of the CBDC will need to cover this clearly.

The existence of an interest charge, both positive or negative, would tend to argue against the CBDC being cash, as cash typically does not have interest transactions with the issuer. Though whether this is definitive is debatable and ultimately for the lawyers and standard setters. There is also a substance over form argument. If people regard CBDC as being a form of cash, and it is the intention of the issuer that it is an equivalent of physical cash, then this may suffice.

If, as some papers on CBDC discuss, the CBDC is not exchanged at 1 to 1, but trades at a premium or discount, this would suggest that the CBDC is more like a security. This brings a new set of accounting issues. The first and possibly most important, is whether it could qualify as a cash equivalent. The practical definition of cash equivalents are financial instruments with a maturity of a maximum of 3 months.[3] But what is the maturity of a CBDC? On one perspective, they might be considered demand instruments, if they can be redeemed at the CB on demand. This would be analogous to banknotes. But the actual maturity of currency is a matter of debate. Although it may legally be repayable on demand (and some countries banknotes state this) in practice the circulation is long lasting and virtually permanent. This has led some commentators to argue that banknotes are not liabilities of the CB but more like a form of capital. In this debate it is at least possible to say that individual banknotes have a limited life due to physical deterioration. The issue will be more difficult with a CBDC which has an indefinite life as it is electronic. It will therefore be important that the legislation clearly states that term of the CBDC. This may not be quite so simple if, as some technology solutions such as blockchain would imply, the individual units of CBDC last forever. However, a possible equivalent scenario for CBDC could be if the blockchain became too long for convenient processing.

Footnotes

[1] Cash equivalents are investments that are (IAS 7.6-9): held for meeting short-term cash commitments rather than for investment or other purposes, highly liquid, readily convertible to known amounts of cash and subject to an insignificant risk of changes in value. AS 7.7 specifies that an investment will ‘normally’ have a maturity of maximum 3 months from the date of acquisition in order to meet the short-term criterion. Although the 3-month period is not set as a strict requirement in IAS 7, it became to be generally accepted as a valid benchmark.

[2] Other entities may also be used by the central banks, and the entries would be similar

[3] Most of the money supply is in the form of bank accounts from which payments can be made. Since these accounts exist electronically, on computers, they are already electronic in digital form. In addition the term emoney is already in use and is defined as ‘Electronic money (e-money) is electronically (including magnetically) stored monetary value, represented by a claim on the issuer, which is issued on receipt of funds for the purpose of making payment transactions’. (UK Electronic Money Regulations 2011).

Appendix A

Accounting Implications Of Transactions In CBDC.

A Issue of 1 million eC by central bank to commercial banks, funded initially by increase in advances to commercial banks

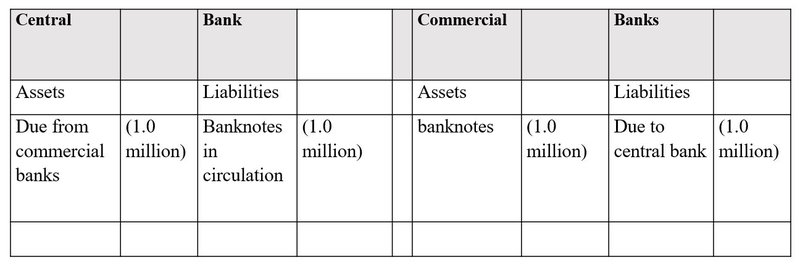

A1 Corresponding withdrawal of banknotes

If following the introduction of eCurrency, there is a corresponding reduction of banknotes, a by LC 1 million.

The two transactions are separate. But the net effect on the central bank balance sheet is a switch on the liability side between eCurrency and banknotes

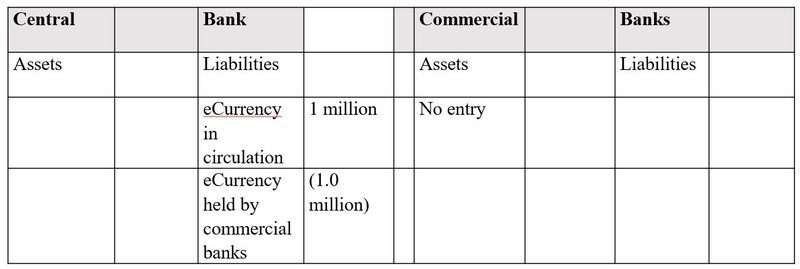

A2 commercial banks introduce CBDC but hold it as agent of the central bank

In this scenario the commercial banks will not buy the CBDC from the central bank, apart from a small amount for their own use. Under this scenario, value is only transferred to the central bank when the CBDC is taken by the bank’s customers.

In this case the central bank will show a liability for CBDC net of amounts held as agents. When the bank issues the CBDC to its customers, it will pay the CB as in example A

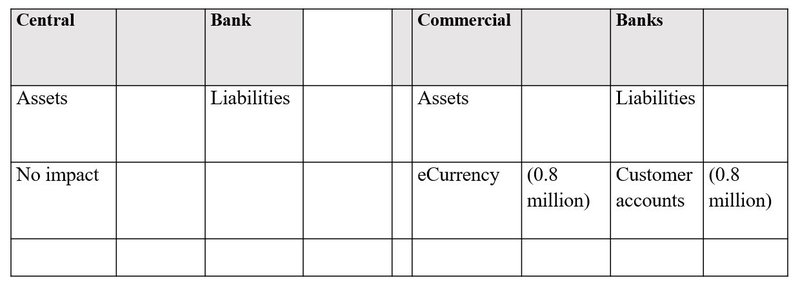

B Customers withdraw 0.8 million of eCurrency into their e wallets

C Public buy 0.8 million of eCurrency directly from central bank, paying with funds from their commercial bank accounts

Note that the overall impact of C is very similar to the aggregate of B and C. The only difference is the eCurrency held by the commercial bank.

Transactions After Currency Has Been Issued

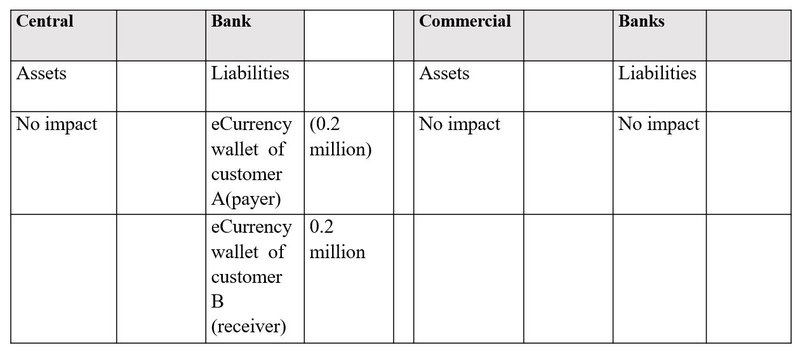

D Customer pay 0.2 million to another customers (for token based CBDC)

E Customer pay 0.2 million to another customers (for account based CBDC run by CB)

Appendix B

Central Bank Digital Currency As A Liability Of The Central Banks

Non central bankers and indeed some central bankers do not always appreciate that the CBDC will be a liability of the central bank. This is one of the major differences between a CBDC and some of the existing cryptocurrencies.

The treatment as a liability is derived from the existing forms of central bank money, that is banknotes and central bank reserves, which are both liabilities of the central bank. So, it is logical that any new form of central bank money should also be a liability.

Central bank reserves are deposit accounts at the central bank, so it is fairly clear that they are liabilities. The counterparties, the commercial banks, can and do use these reserves for settlement of their transactions, as they would any other account.

The position with banknotes is a bit less obvious. When banknotes were first created, several hundred years ago, they were issued in return for deposits, or perhaps as evidence of a deposit. And there was always the intention that they could be paid. Indeed to this day, the Bank of England notes still contain the statement ‘ I promise to pay the bearer on the demand the sum of x pounds’, where X is the denomination of the note. Other central banks do not have such a statement and indeed may never have gone through the stage of issuing notes as evidence of deposits. But they retain the intention and obligation to repay notes when presented to them. This may or may not be a strict legal requirement, but it is practical reality.

The history of money is a matter for others and no doubt there are many versions. It is not the prime consideration. The prime consideration is not the legal form but the accounting which is based on the substance not the form. The International Public Sector Accounting Standards Board considered this when preparing their Exposure Draft 69 on public sector specific financial instruments, which includes currency. The conclusion, which is not yet issued as a standard, is that banknotes will be a liability in most cases, but is worded to allow some legal tender such as coins, to be excluded.

What is the present situation in practice with respect to banknotes?

A central bank expects to repay its banknotes. This applies to individual notes, which have a limited life and so will be returned to the CB. Contrary to popular assertion, returning a note will not necessarily result in the issue of a new one. The holder of the note may well ask for a transfer to a bank account.

There is a significant daily inflow and outflow of banknote between the central bank and its customers, principally commercial banks. Banks tend to withdraw notes in the morning, for their needs and return surplus notes at the end of the day. The counterpart to these transactions is transfers to/from the commercial bank accounts at the CB, ie the reserves described above.

Some central banks withdraw and individual series of notes. For example, when paper notes are replaced by ‘plastic’ notes. At this point all the old notes are taken in and repaid (normally over a period of time). The new notes will not be issued on a one to one basis.

Finally, in rare circumstances all the banknotes are withdrawn and repaid. An example was the introduction of the euro bank notes. All the old national currency notes were withdrawn and repaid, as obligations of the national central bank concerned. The new euro banknotes were issued as obligations of the Eurosystem.

The holders of banknotes, the public, may not think of their precise status very often, but do expect to get value for them, whenever they wish. This will normally be by exchange for goods and services, but at some point in the process, the notes will normally be paid in to a commercial bank and be exchanged for value, not another note. The bank will only give this value because it knows it can take the note to the central bank for value.

A further argument can be demonstrated when the authorities decide to withdraw a note without giving value, for example in India. The public reaction showed that they regarded the notes as an obligation of the authorities. The failure to repay was not appreciated and resulted in a loss of value

So irrespective of any legal requirements, it is clear to central banks that they have an obligation to repay banknotes. Therefore, they regard them as liabilities. These are outright obligations not contingent liabilities.

As stated above, since both existing forms of central bank money are liabilities of the CB. So it is natural for another version of central bank money to also be a liability. Particularly if it is intended to be interchangeable with the other forms.

The CBDC may be withdrawn or repaid at the wish of the central banks or of the public. The ability for the public, including banks to ask for repayment is important in making them a demand liability.

A further point is that for the CBDC to be regarded as a financial instrument, if this is required, it is necessary under IFRS 9 for the CBDC to be a liability of the issuer.

The only type of ‘money’ that may not be recognised as a liability of anyone, is coins. If these are issued by the central bank, these may be treated as a liability. But in many jurisdictions, coins are issued by the central government, commonly by the Finance Ministry. Governments generally do not recognise the coins as a liability. This is possible because, (i) the coins remain in circulation for many years, decades, as against the life of a note which is only a few years at most. And (ii) the amounts are small as compared to other forms of money, so the impact on both the economy and for individuals are similarly small.

For completeness and some clarification it is worth looking at the current definitions of asset and liability as contained in the Conceptual framework.

Asset

An asset is a present economic resource controlled by an entity as a result of past events.

An economic resource is a right that has the potential to produce economic benefits.

Liability

A liability is a present obligation of an entity to transfer an economic resource as a result of past events.

An obligation is a duty or responsibility that an entity has no practical ability to avoid.

How does a CBDC fit these criteria?

The CBDC meets the requirement as an economic resource, because it can be used to buy goods or services, or to settle liabilities. These are economic benefits.

The more difficult question is whether the central bank has an obligation to transfer an economic resource. The wording for obligation does not require a legal provision though this would be clarification. If the central bank considers that it has a duty or a responsibility to honour its CBDC, and one that it cannot practically avoid, this would be sufficient. If a central bank announced that it did not consider it had such a duty or responsibility, the impact on the acceptability of the CBDC is likely to be significant. Thus whatever the law says, it would be difficult in practice for a central bank to avoid its duty or responsibility.